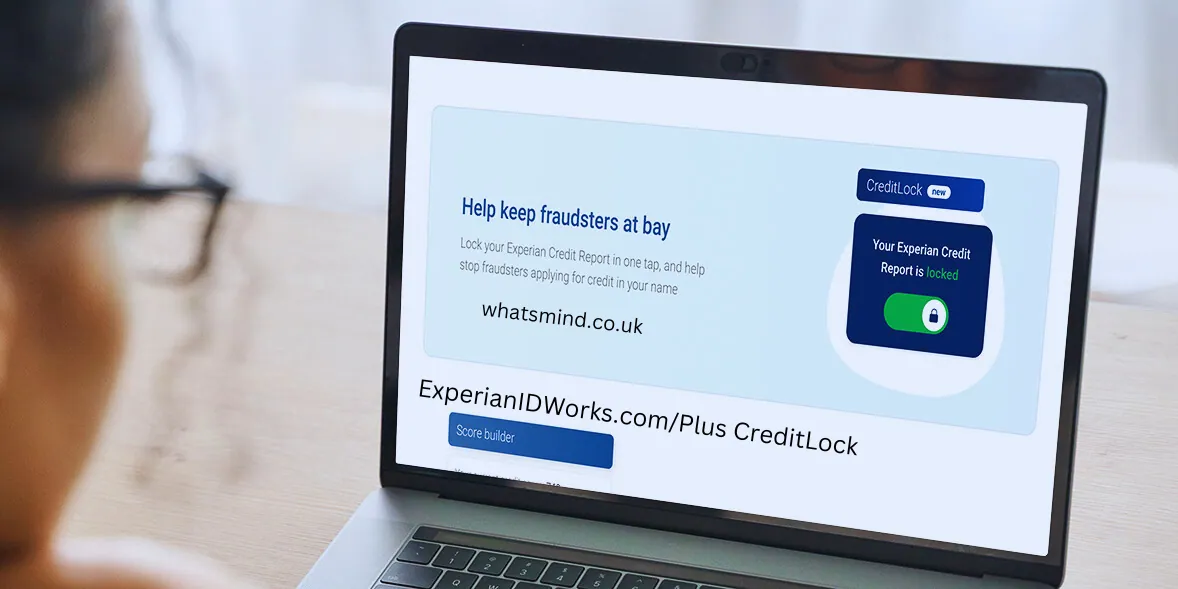

In an age where identity theft and credit fraud are rampant, safeguarding your personal information is of utmost importance. One service that has gained attention in this realm is Experian’s CreditLock feature available through ExperianIDWorks.com. This article aims to provide a detailed overview of this service, including how it works, its benefits, and how it can impact your financial future. We will also address some frequently asked questions about CreditLock to ensure all your queries are answered.

What is ExperianIDWorks.com/Plus CreditLock?

ExperianIDWorks.com/Plus CreditLock is a service offered by Experian, one of the three major credit reporting agencies. This service is part of the broader range of identity protection offerings provided by Experian ID Works, which aims to give consumers peace of mind when it comes to their credit and personal identity.

CreditLock allows users to lock and unlock their credit reports at their convenience. This gives subscribers additional control over who can access their credit information, which is particularly beneficial in preventing unauthorized access and potential identity theft. When you lock your credit report, lenders cannot view your credit profile, thereby blocking any new credit accounts from being opened in your name without your permission.

How Does CreditLock Work?

The process of using CreditLock is straightforward:

- Enrollment: To begin using CreditLock, you first need to enroll in the Experian ID Works service. This typically involves creating an account on ExperianIDWorks.com and providing the necessary personal information for verification.

- Locking Your Credit Report: Once enrolled, users can easily lock their credit report through the Experian website or mobile app. A simple click is all it takes to lock your credit.

- Unlocking Your Credit Report: If you need to apply for new credit, you can unlock your credit report at any time. This is often done through the same platform where you locked it, allowing for seamless management of your credit access.

- Real-Time Alerts: Experian CreditLock provides alerts for significant changes to your credit file, such as new accounts being opened or inquiries made on your report, making monitoring your finances easier.

Benefits of Using ExperianIDWorks.com/Plus CreditLock

The key benefits of utilizing CreditLock through Experian are significant and can provide peace of mind in managing your credit.

1. Enhanced Security

CreditLock significantly reduces the risk of identity theft. By restricting access to your credit report, potential thieves are deterred from opening new accounts in your name. This means that even if someone obtains your personal information, they cannot use it to create unauthorized credit accounts.

2. Convenience

The ability to lock and unlock your credit report at any time is incredibly convenient. Whether you’re considering applying for a loan or just want to secure your report for a while, the mobile app and website make it easy to manage your credit access from anywhere.

3. Real-Time Monitoring

Experian’s alerts allow you to keep an eye on any changes to your credit report. This proactive approach ensures you are informed about your credit status, helping you catch any unusual or potentially harmful activities early.

4. Peace of Mind

Knowing that you have control over who accesses your credit report can provide significant peace of mind. The fear of identity theft can be overwhelming, but with CreditLock, you have taken a proactive step to protect your information.

FAQs About ExperianIDWorks.com/Plus CreditLock

1. Is there a cost associated with CreditLock?

Yes, there may be a subscription fee associated with Experian ID Works services, including CreditLock. The pricing details can vary based on the service level you choose.

2. Can I use CreditLock if I have a freeze on my credit report?

If you currently have a credit freeze, you will need to temporarily lift the freeze before you can utilize CreditLock.

3. How long does it take to lock or unlock my credit report?

The process to lock or unlock your credit report is instantaneous when using the online platform or mobile app.

4. Will locking my credit affect my credit score?

No, using CreditLock itself does not impact your credit score. It merely restricts access to your credit report.

5. What should I do if I think my personal information has been compromised?

If you suspect that your information is stolen, immediately lock your credit report using CreditLock. It’s also advisable to place a fraud alert on your credit file and consider filing a report with the FTC.

Conclusion

ExperianIDWorks.com/Plus CreditLock is a valuable tool in the battle against identity theft and credit fraud. By giving consumers the ability to control access to their credit reports, this service enhances security and peace of mind. With easy lock and unlock options, real-time monitoring, and the ability to catch potentially harmful activity early, CreditLock empowers individuals to take charge of their financial future confidently.

As technology continues to evolve, services like CreditLock will become increasingly essential in protecting our personal information. For anyone concerned about identity theft, considering the features and benefits of ExperianIDWorks.com/Plus CreditLock is a wise decision.